The Affordable Housing Crisis: Causes and Cures ...

First published: February 11, 2015

Last updated: September 9, 2017

The reasons California home prices and rents are so high has been well documented in reports published by an assortment of organizations including the California Legislative Analyst's Office (LAO) and the Federal Reserve Bank of New York (FRBNY). To summarize these reports, the highest housing costs, where they are found, are the result of restrictive zoning codes, a tortuous planning process, high government fees and other government regulations. In other words, we have a government induced shortage of supply.

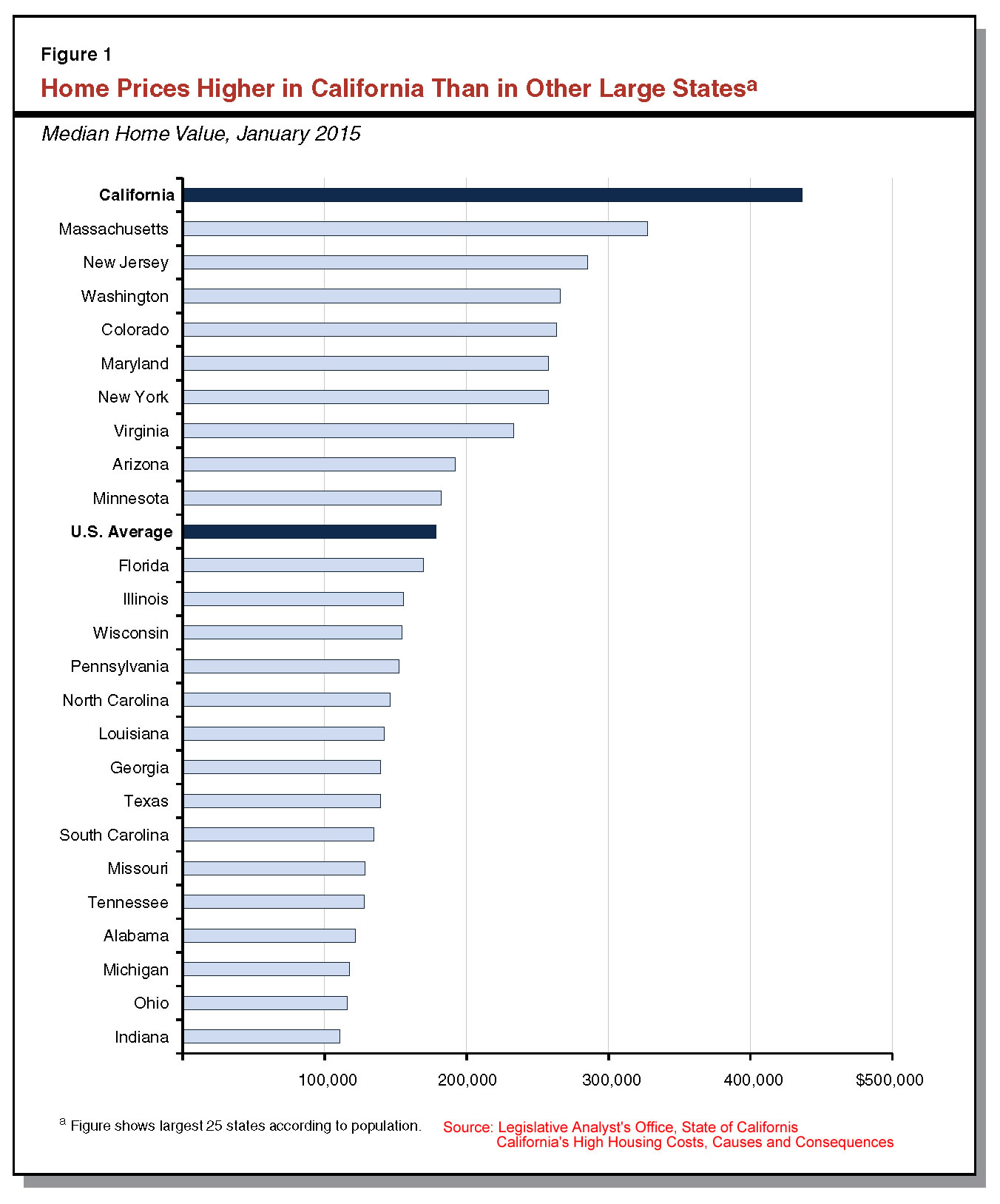

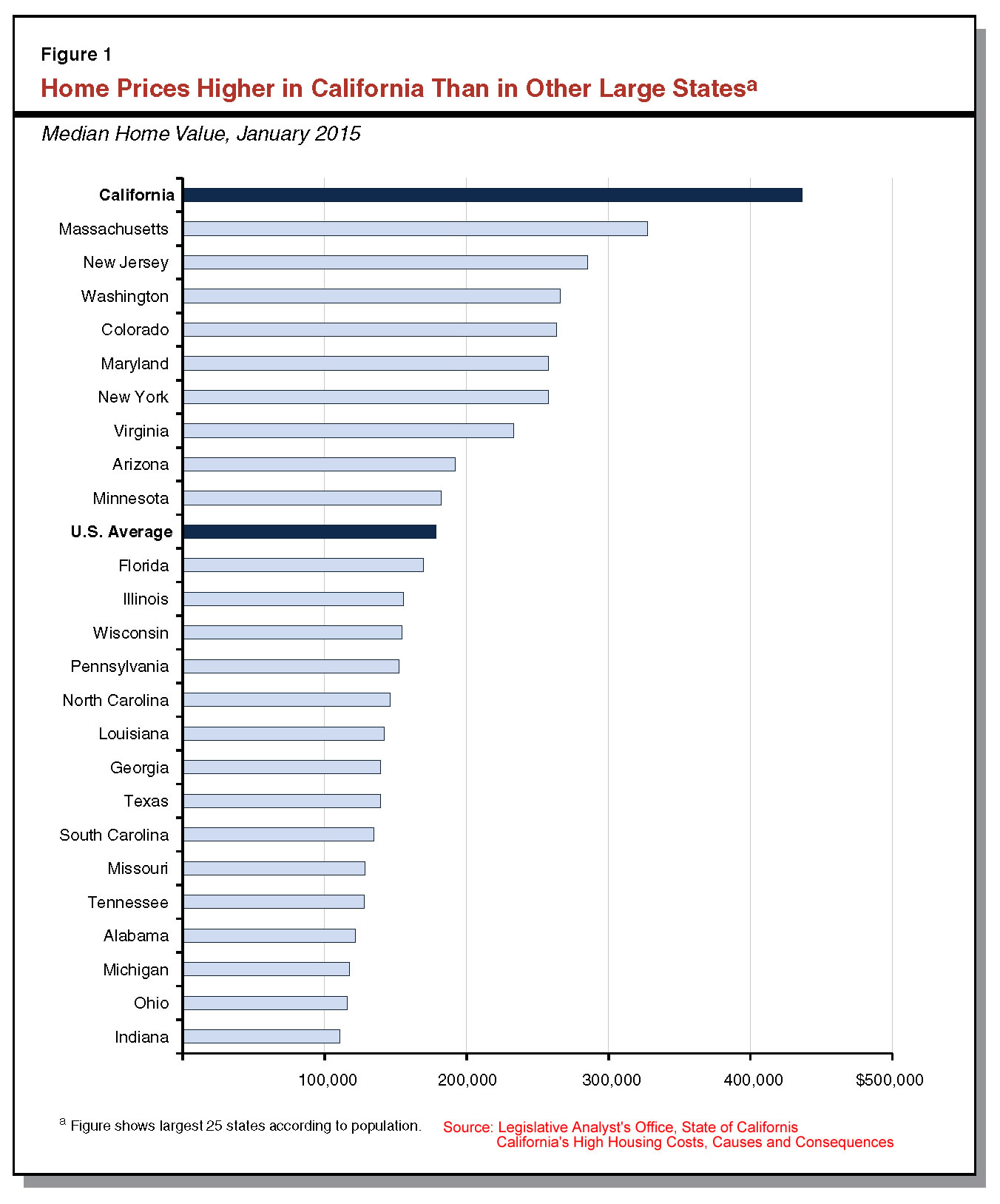

California is in the beginning stages of a housing affordability crisis that will only get worse. California's Legislative Analyst's Office (LAO) released a report in 2015 on California's high housing costs. Among other things, the report concluded that California needed to build in the neighborhood of 100,000 more housing units each year than it was currently building. It is this housing shortage that causes median home prices to be about 2.4 times higher than the national average and about 3 times higher than the median home price in Texas.

Renters feel the effects as well. The average rent nationally for a 1 bedroom apartment is $1,018 but it's $2,483 in San Jose and $3,240 in San Francisco.

Last updated: September 9, 2017

The reasons California home prices and rents are so high has been well documented in reports published by an assortment of organizations including the California Legislative Analyst's Office (LAO) and the Federal Reserve Bank of New York (FRBNY). To summarize these reports, the highest housing costs, where they are found, are the result of restrictive zoning codes, a tortuous planning process, high government fees and other government regulations. In other words, we have a government induced shortage of supply.

California is in the beginning stages of a housing affordability crisis that will only get worse. California's Legislative Analyst's Office (LAO) released a report in 2015 on California's high housing costs. Among other things, the report concluded that California needed to build in the neighborhood of 100,000 more housing units each year than it was currently building. It is this housing shortage that causes median home prices to be about 2.4 times higher than the national average and about 3 times higher than the median home price in Texas.

Renters feel the effects as well. The average rent nationally for a 1 bedroom apartment is $1,018 but it's $2,483 in San Jose and $3,240 in San Francisco.

THE CAUSES IN A LITTLE MORE DETAIL:

"The Impact of Building Restrictions on Housing Affordability," published by the Federal Reserve Bank of New York (FRBNY), concluded that the highest prices, where they exist, are the result of zoning and other land use controls.

The State of California's Legislative Analyst's Office (LAO) released its report titled "California's High Housing Costs: Causes and Consequences." The LAO report identifies a lack of supply in California's coastal communities as the primary cause of California's high housing costs. Among other things, it noted that "over two-thirds of cities and counties in California’s coastal metros have adopted growth control policies explicitly aimed at limiting housing growth." Even when it's not explicitly prohibited, it's still difficult to get projects approved. A consortium of developers spent $17.2 million on the planning phase of San Jose's Coyote Valley before abandoning their plans. Even if they successfully navigated the planning phase, the lawsuits from environmental groups and neighbors that were sure to follow would have created unknown additional costs and years of delay.

A 2009 paper from the CATO institute entitled "How Urban Planners Caused the Housing Bubble" provides a compelling case that restrictive planning regulations and high government fees created an artificial shortage of housing. Among things cited in the CATO paper is that "The eight counties in the San Francisco Bay Area, for example, have collectively drawn urban-growth boundaries that exclude 63 percent of the region from development. Regional and local park districts have purchased more than half of the land inside the boundaries for open space purposes. Virtually all of the remaining 17 percent has been urbanized, making it nearly impossible for developers to assemble more than a few small parcels of land for new housing or other purposes." The San Jose Mercury News ran a story on July 13, 2014 titled "Bay Area home builders struggle to keep up with demand." It indicated Bay Area developers were paying $3 Million to $5 Million per acre for development land.

The Independent Institute looked at affordable housing mandates that require builders to set aside a certain percentage of their homes for sale at below market rates. San Jose, for example, has an inclusionary housing ordinance that requires builders of 20 or more housing units to sell 15% of the units at below market prices or set aside $122,000 for each below market home that is not sold. In "Below-Market Housing Mandates as Takings: Measuring their Impact" the authors concluded that "cities that impose a below-market housing mandate actually end up with 10 percent fewer homes and 20 percent higher prices."

Likewise, tax credits and subsidies given to wealthy builders to promote the construction of below market rate housing do not increase the supply of housing as much as they add buyers competing for a limited amount of land upon which housing can be built. For instance, how many more developers are needed in the Bay Area to bid up land prices where existing developers are already paying $3 million to $5 million per acre for development land? Clearly, what is needed is more land upon which to build.

Another impediment to providing an adequate supply of homes are the high fees charged by some government entities. The cost of building permits and other direct fees is currently over $50,000 per home here in rural Yuba City where the median home price is about $285,000.. That doesn't include another $20,000 to $25,000 in lost purchasing power from Mello-Roos taxes that are added to the annual tax bill.

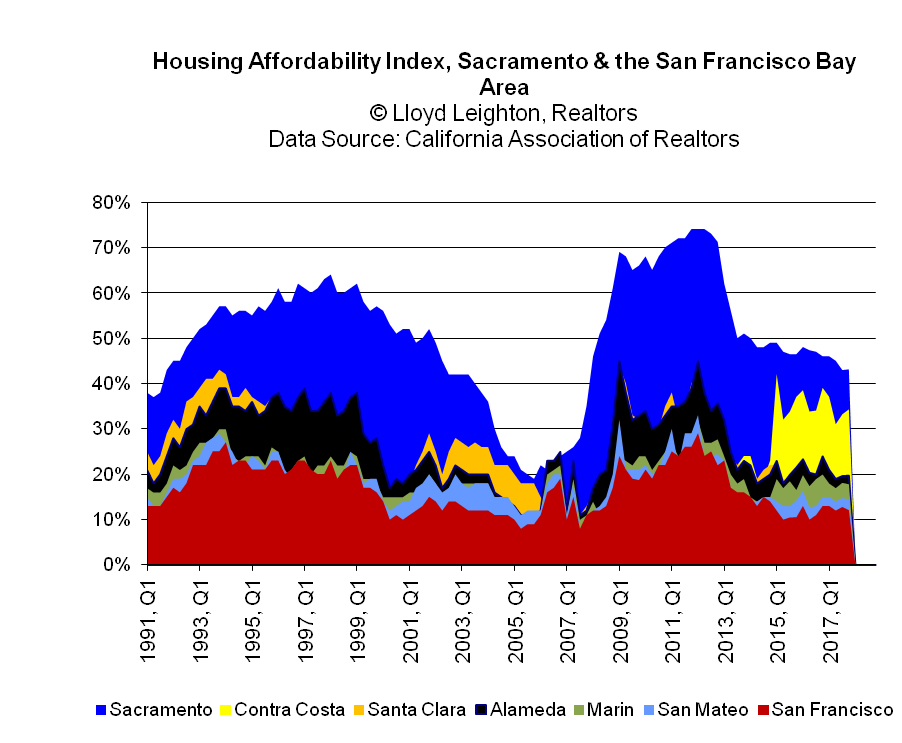

The LAO's report also says that "California’s inland metros added housing at about twice the rate of the typical U.S. metro between 1980 and 2010" but that high prices there are due largely to the spillover effect from the inadequate supply in the coastal areas. While prices in the inland metros may be higher than the national average, the extra supply has clearly had a positive impact on housing affordability. The Housing Affordability Index (HAI) measures the percentage of households that can afford to purchase the median priced home. Here is a comparison of the Housing Affordability Index for inland Sacramento County and the coastal metropolitan counties of the San Francisco Bay Area (Santa Clara, Alameda, Contra Costa, Marin, San Mateo, Sonoma and San Francisco).

"The Impact of Building Restrictions on Housing Affordability," published by the Federal Reserve Bank of New York (FRBNY), concluded that the highest prices, where they exist, are the result of zoning and other land use controls.

The State of California's Legislative Analyst's Office (LAO) released its report titled "California's High Housing Costs: Causes and Consequences." The LAO report identifies a lack of supply in California's coastal communities as the primary cause of California's high housing costs. Among other things, it noted that "over two-thirds of cities and counties in California’s coastal metros have adopted growth control policies explicitly aimed at limiting housing growth." Even when it's not explicitly prohibited, it's still difficult to get projects approved. A consortium of developers spent $17.2 million on the planning phase of San Jose's Coyote Valley before abandoning their plans. Even if they successfully navigated the planning phase, the lawsuits from environmental groups and neighbors that were sure to follow would have created unknown additional costs and years of delay.

A 2009 paper from the CATO institute entitled "How Urban Planners Caused the Housing Bubble" provides a compelling case that restrictive planning regulations and high government fees created an artificial shortage of housing. Among things cited in the CATO paper is that "The eight counties in the San Francisco Bay Area, for example, have collectively drawn urban-growth boundaries that exclude 63 percent of the region from development. Regional and local park districts have purchased more than half of the land inside the boundaries for open space purposes. Virtually all of the remaining 17 percent has been urbanized, making it nearly impossible for developers to assemble more than a few small parcels of land for new housing or other purposes." The San Jose Mercury News ran a story on July 13, 2014 titled "Bay Area home builders struggle to keep up with demand." It indicated Bay Area developers were paying $3 Million to $5 Million per acre for development land.

The Independent Institute looked at affordable housing mandates that require builders to set aside a certain percentage of their homes for sale at below market rates. San Jose, for example, has an inclusionary housing ordinance that requires builders of 20 or more housing units to sell 15% of the units at below market prices or set aside $122,000 for each below market home that is not sold. In "Below-Market Housing Mandates as Takings: Measuring their Impact" the authors concluded that "cities that impose a below-market housing mandate actually end up with 10 percent fewer homes and 20 percent higher prices."

Likewise, tax credits and subsidies given to wealthy builders to promote the construction of below market rate housing do not increase the supply of housing as much as they add buyers competing for a limited amount of land upon which housing can be built. For instance, how many more developers are needed in the Bay Area to bid up land prices where existing developers are already paying $3 million to $5 million per acre for development land? Clearly, what is needed is more land upon which to build.

Another impediment to providing an adequate supply of homes are the high fees charged by some government entities. The cost of building permits and other direct fees is currently over $50,000 per home here in rural Yuba City where the median home price is about $285,000.. That doesn't include another $20,000 to $25,000 in lost purchasing power from Mello-Roos taxes that are added to the annual tax bill.

The LAO's report also says that "California’s inland metros added housing at about twice the rate of the typical U.S. metro between 1980 and 2010" but that high prices there are due largely to the spillover effect from the inadequate supply in the coastal areas. While prices in the inland metros may be higher than the national average, the extra supply has clearly had a positive impact on housing affordability. The Housing Affordability Index (HAI) measures the percentage of households that can afford to purchase the median priced home. Here is a comparison of the Housing Affordability Index for inland Sacramento County and the coastal metropolitan counties of the San Francisco Bay Area (Santa Clara, Alameda, Contra Costa, Marin, San Mateo, Sonoma and San Francisco).

THE DISPARATE IMPACT OF THESE RESTRICTIVE POLICES:

Wealthy homeowners in coastal communities enjoy the benefit of home prices that appreciate at artificially high rates. As landlords, they also benefit from the artificially high rents that result from these policies. Moderate income households fortunate enough to have purchased homes years ago have amassed a great deal of wealth from artificially inflated prices..

Low and moderate income households who are not property owners suffer. The LAO report identified significant trade-offs these households make when faced with high housing costs. These include;

The recent news is not good;

Wealthy homeowners in coastal communities enjoy the benefit of home prices that appreciate at artificially high rates. As landlords, they also benefit from the artificially high rents that result from these policies. Moderate income households fortunate enough to have purchased homes years ago have amassed a great deal of wealth from artificially inflated prices..

Low and moderate income households who are not property owners suffer. The LAO report identified significant trade-offs these households make when faced with high housing costs. These include;

- Spending a larger share of income on housing.

- Commuting further to work each day.

- Postponing or foregoing homeownership.

- Living in more crowded housing.

- Living in substandard housing.

- Living near sources of pollution.

- Choosing to work and live elsewhere.

The recent news is not good;

- The San Jose Mercury News ran a story on July 13, 2014 titled "Bay Area home builders struggle to keep up with demand." It indicated Bay Area developers were paying $3 Million to $5 Million per acre for development land.

- It ran another story on November 2, 2014 titled "Modest Bay Area homes hit mind-boggling prices." That story detailed several recent homes sales including one unspectacular 992 square foot Palo Alto home that sold for $3 Million.

- The Sacramento Bee ran a story on November 30, 2014 titled "Investors scoop up apartments as rents rise, vacancies fall in Sacramento area." That story reported that rental vacancies in the Sacramento area had hit a record low of 3.8%

- The number of homes listed for sale in all of Sacramento County dropped from 3,329 active listings November 1, 2014 to 2,237 active listings on February 1, 2015.

- The San Jose Mercury News ran a story on April 22, 2015 titled "Rents soar 14.8 percent in San Francisco, rise 3.7 percent nationwide" and reported that the average rent is more than $3,000 per month in the Bay Area.

- The San Jose Mercury News ran a story on September 30, 2015 "Bay Area commuting nightmares: jobs in city, affordable homes in exurbia" that says "When the U.S. Census Bureau crunched the numbers in 2013, it found that about 115,000 commuters traveled 90 or more minutes to their jobs in the San Francisco-Oakland and San Jose metropolitan areas." That's over three hours a day spent commuting to and from work.

Affordable Housing Solutions:

The LAO's report noted that "the state has approached the problem of housing affordability for low-income Californians and those with unmet housing needs primarily by subsidizing the construction of affordable housing ..." It concluded that this approach has only accounted for a small fraction of the needed housing. It goes on to say "We advise the Legislature to change policies to facilitate significantly more private home and apartment building in California’s coastal urban areas."

It seems doubtful that California legislators understand the nature and magnitude of the problem. Given that the Legislative Analyst has identified that we need to build in the neighborhood of 100,0000 more new housing units a year in coastal California than we a currently building, it's easy to see that there is a shortfall in construction of roughly $50 billion. The Legislature's response is a bond to raise $4 billion. A one time fix of $4 billion dollars is a drop in the bucket when compared to an annual shortage of $50 billion. State Senator Toni Atkins said the State needed to take "bold action" to address the housing affordability crisis when she first announced a proposed $75 tax on deeds and deeds of trust. That new tax was estimated to raise in the neighborhood of $200 to $250 million per year. It's hard to imagine a more trivial response to a $50 billion problem.

Even if California's politicians do understand the problem, there is no evidence they possess the political will to take on the environmentalists and mostly moderate income home owing households who will show up at planning meetings prepared to fight tooth and nail to stop any proposed new housing developments. Given the political climate in Sacramento, legal action may hold more promise for solving the problem of an inadequate supply of homes.

Legal action may be required to solve the problem;

IMPROVING INCOMES

California currently ranks 49th in economic freedom among the 50 states. It also has the 2nd or 3rd highest level of income inequality, depending on the metric used, according to the Center on Budget and Policy Priorities. Understand that economic freedom is distinctly different than the crony capitalism that rewards large and politically well connected businesses and labor unions with special tax breaks and other favors.

Why is economic freedom important? According to Antony Davis, economics professor at Duquesne University, states and countries with more economic freedom tend to;

Increasing economic freedom holds the promise of improving housing affordability by increasing the income of low and moderate income households. One would suspect that Texas, which ranks 14th in terms of economic freedom would have much more income equality than California but it doesn't. Texas ranks as the 7th highest state in terms of income inequality.

Another index that helps explain the income inequality index shows which states have the highest percentage of illegal immigrants.

Illegal immigrants accounted for 9.7% of the California work force and 9.0% of the Texas workforce. Even in states with good economic freedom, illegal immigrants find themselves locked into low paying jobs without much opportunity for advancement. They aren't free to take any job they want. They aren't free to start any type of business they want. There are limits on how much they are willing to expand their businesses for fear that their illegal status will be discovered. They are often unwilling to report crimes against them for the same reason. Rightly or wrongly, they lack liberty.

Granting legal status to illegal immigrants is perhaps one of the simplest ways to broadly boost the economy and increase the income of both legal and illegal low and moderate income households. Raúl Hinojosa-Ojeda is director of the North American Integration and Development Center at the University of California at Los Angeles. According to Bloomberg Business and the CATO Institute, he estimates "that a comprehensive immigration plan that includes a way for undocumented workers to gain legal status would increase tax revenue by $4.5 billion or more over three years, and increase gross domestic product by $1.5 trillion over 10 years. That includes $1.2 trillion in additional consumption and $256 billion in investment as immigrants buy houses and start businesses. Average wages of low-skill immigrant workers would increase by $4,405 a year for the first three years, he estimates. For skilled workers, wages would rise by more than $6,100 a year." The benefits of this economic expansion affect all segments of the economy, not just illegal immigrants.

Improving housing affordability will be well served by;

Thank you for the time you took to listen to my thoughts,

Lloyd Leighton

Yuba City, CA

The LAO's report noted that "the state has approached the problem of housing affordability for low-income Californians and those with unmet housing needs primarily by subsidizing the construction of affordable housing ..." It concluded that this approach has only accounted for a small fraction of the needed housing. It goes on to say "We advise the Legislature to change policies to facilitate significantly more private home and apartment building in California’s coastal urban areas."

It seems doubtful that California legislators understand the nature and magnitude of the problem. Given that the Legislative Analyst has identified that we need to build in the neighborhood of 100,0000 more new housing units a year in coastal California than we a currently building, it's easy to see that there is a shortfall in construction of roughly $50 billion. The Legislature's response is a bond to raise $4 billion. A one time fix of $4 billion dollars is a drop in the bucket when compared to an annual shortage of $50 billion. State Senator Toni Atkins said the State needed to take "bold action" to address the housing affordability crisis when she first announced a proposed $75 tax on deeds and deeds of trust. That new tax was estimated to raise in the neighborhood of $200 to $250 million per year. It's hard to imagine a more trivial response to a $50 billion problem.

Even if California's politicians do understand the problem, there is no evidence they possess the political will to take on the environmentalists and mostly moderate income home owing households who will show up at planning meetings prepared to fight tooth and nail to stop any proposed new housing developments. Given the political climate in Sacramento, legal action may hold more promise for solving the problem of an inadequate supply of homes.

Legal action may be required to solve the problem;

- These restrictive housing policies have a disparate impact on low income households as compared to wealthy households. The wealthy benefit from artificially high real estate appreciation rates while low income households suffer from artificially high rents and a host of other issues.

- To the extent that minorities, particularly Hispanic and African-American, are over represented in the low income categories, these polices have a disparate impact on them.

- The U.S. Supreme Court recently ruled that public policies that have a disparate impact on minorities violate the Federal Fair Housing Act (FHA) even though no discrimination was intended (Texas Dept. of Housing and Community Affairs v. Inclusive Communities Project, Inc.).

- It seems to me that a legal action under the Federal Fair Housing Act will serve the affordable housing goals we should all be striving for. If successful, it would open up the building process and help all low and moderate income households, not just the minorities.

IMPROVING INCOMES

California currently ranks 49th in economic freedom among the 50 states. It also has the 2nd or 3rd highest level of income inequality, depending on the metric used, according to the Center on Budget and Policy Priorities. Understand that economic freedom is distinctly different than the crony capitalism that rewards large and politically well connected businesses and labor unions with special tax breaks and other favors.

Why is economic freedom important? According to Antony Davis, economics professor at Duquesne University, states and countries with more economic freedom tend to;

- Make it easier to start or expand a business.

- Make it easier for low and middle class families to create wealth.

- Have lower unemployment rates.

- Have more income equality.

- Have more gender equality.

- Have lower child labor rates.

- Have higher economic growth rates.

- Have less debt per GDP.

Increasing economic freedom holds the promise of improving housing affordability by increasing the income of low and moderate income households. One would suspect that Texas, which ranks 14th in terms of economic freedom would have much more income equality than California but it doesn't. Texas ranks as the 7th highest state in terms of income inequality.

Another index that helps explain the income inequality index shows which states have the highest percentage of illegal immigrants.

Illegal immigrants accounted for 9.7% of the California work force and 9.0% of the Texas workforce. Even in states with good economic freedom, illegal immigrants find themselves locked into low paying jobs without much opportunity for advancement. They aren't free to take any job they want. They aren't free to start any type of business they want. There are limits on how much they are willing to expand their businesses for fear that their illegal status will be discovered. They are often unwilling to report crimes against them for the same reason. Rightly or wrongly, they lack liberty.

Granting legal status to illegal immigrants is perhaps one of the simplest ways to broadly boost the economy and increase the income of both legal and illegal low and moderate income households. Raúl Hinojosa-Ojeda is director of the North American Integration and Development Center at the University of California at Los Angeles. According to Bloomberg Business and the CATO Institute, he estimates "that a comprehensive immigration plan that includes a way for undocumented workers to gain legal status would increase tax revenue by $4.5 billion or more over three years, and increase gross domestic product by $1.5 trillion over 10 years. That includes $1.2 trillion in additional consumption and $256 billion in investment as immigrants buy houses and start businesses. Average wages of low-skill immigrant workers would increase by $4,405 a year for the first three years, he estimates. For skilled workers, wages would rise by more than $6,100 a year." The benefits of this economic expansion affect all segments of the economy, not just illegal immigrants.

Improving housing affordability will be well served by;

- Articulating to government officials and the public that high home prices are the result of government policies that restrict the supply of homes.

- Facilitating more private housing construction by reducing the government regulations that have led to artificial housing shortages.

- Reducing the high government fees placed on builders.

- Stop rewarding large corporations and wealthy individuals with tax credits and other inducements to build housing.

- Dealing with the immigration issue. This doesn't mean granting citizenship to illegal immigrants. It does mean facing the fact we aren't going to deport every illegal immigrant given that 9.7% of California’s workforce, 9.0% of Texas’ workforce and 10% of Nevada’s workforce are here illegally. Granting them some sort of legal status will permit them to prosper and add to our economy. Keeping them in the shadows and poor does nothing to improve our economy.

Thank you for the time you took to listen to my thoughts,

Lloyd Leighton

Yuba City, CA

What Clients Are Saying

Contact

Lloyd Leighton Realtors

Address: 1212 Highland Avenue

Yuba City, CA 95991-6115

Phone: (530) 671-6152

Fax: (530) 671-3904

Cal BRE Lic. #00951505